The State of Proptech Venture Capital: 2025 Year-End Analysis

Summary: Proptech venture capital entered 2025 amid cautious expectations driven by constrained exits, higher interest rates, and tighter underwriting, yet capital deployment ultimately exceeded pre-pandemic levels. CRETI’s end-of-year analysis shows $16.7 billion invested globally, reflecting a disciplined recovery rather than a return to prior-cycle excess. Capital concentrated into a small number of large transactions, with debt and structured financings dominating at scale while venture equity moved decisively earlier. Seed and Series A activity remained strong as growth-stage valuations reset, reinforcing a market focused on capital efficiency, retention, and alignment with real-asset economics. As the sector enters 2026, proptech investing is defined less by momentum and more by durability, execution, and the ability to underwrite technology businesses that increasingly resemble infrastructure rather than software experiments.

In 2025, proptech venture capital did not rebound in the way many market participants expected. Investor sentiment entering the year was cautious and broadly aligned with expectations, shaped by constrained exits, higher interest rates, and tighter underwriting standards. Yet capital deployment told a more nuanced story. Investment activity reached its highest level in three years and exceeded pre-pandemic benchmarks, signaling not a return to excess, but a market that had recalibrated how capital is deployed.

As Ashkán Zandieh, Managing Director of CRETI, observed during the year-end Venture Board meeting, “What we saw in 2025 was not a re-inflation of the market. It was capital returning with memory. Investors were active again, but far more deliberate about where risk truly belonged.”

CRETI’s end-of-year data shows that $16.7 billion was invested globally in proptech and adjacent real estate technology companies in 2025, a 67.9% year-over-year increase from 2024. Total investment also surpassed 2019 levels, when the sector attracted approximately $14 billion. This marked a clear recovery in capital formation, even as investor behavior remained disciplined.

“This was not a return to 2021,” Zandieh noted. “It looked much closer to 2019 in character, but operating at a larger and more complex scale. Capital came back, but the rules had changed.”

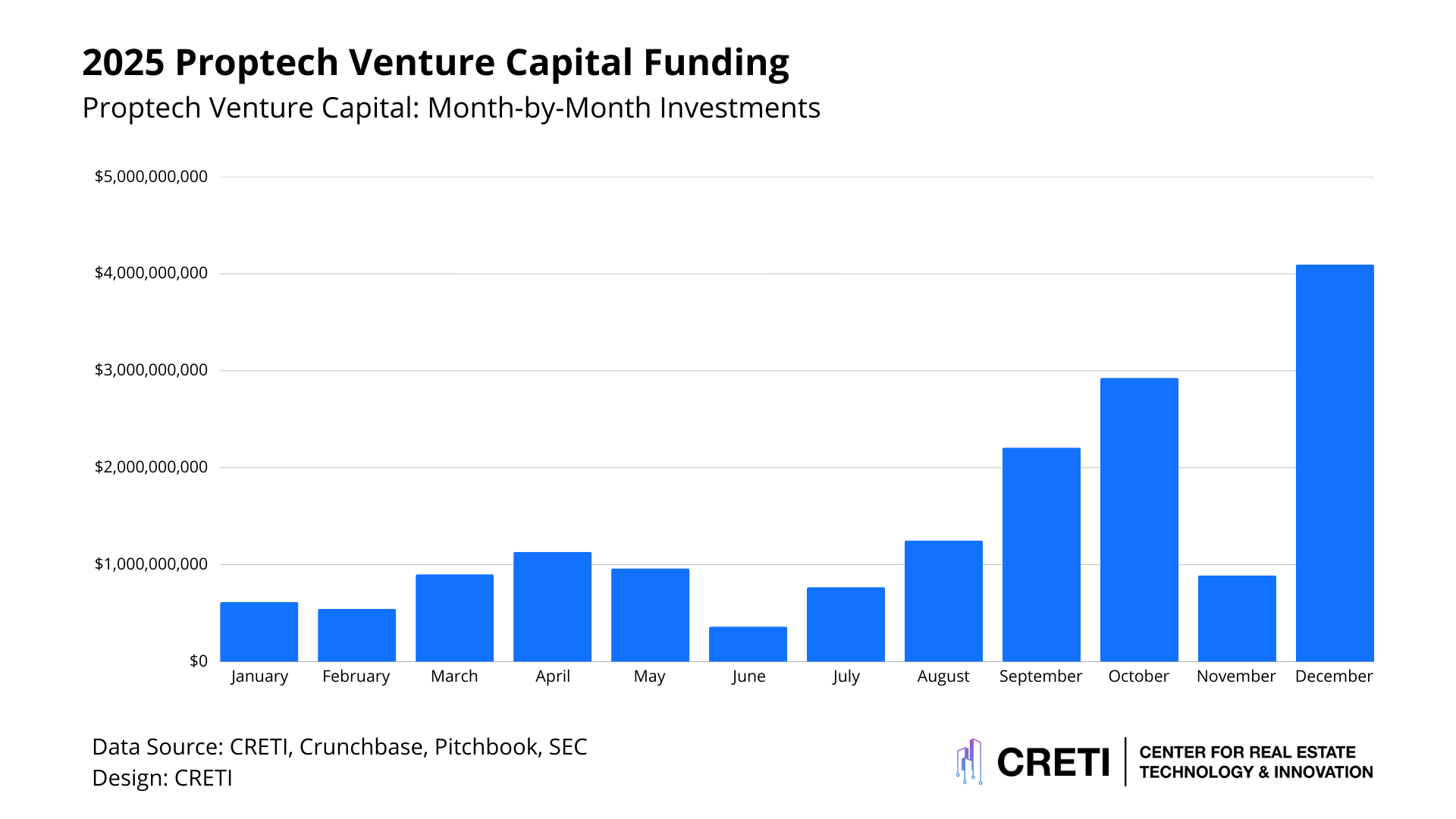

Quarterly data illustrate how momentum was rebuilt over the course of the year. Investment activity accelerated meaningfully in the second half of 2025, with fourth-quarter deployment alone exceeding $7.9 billion, the strongest quarterly performance since 2021. This late-year surge reflected delayed commitments, clearer underwriting, and growing confidence in a narrower set of business models capable of delivering durable returns.

The defining feature of 2025 was not simply how much capital was deployed, but how concentrated it became. Of the $16.7 billion invested during the year, $12 billion was allocated to financings of $100 million or more, with just 35 companies accounting for 71.9% of total capital invested. Capital formation was driven by a limited number of large transactions rather than broad-based deployment across the long tail of early-stage startups.

More telling was the structure of that capital. Approximately 77% of $100 million-plus financings were debt, securitizations, or private-equity-style investments, while traditional venture equity accounted for a minority of such transactions. Ajey Kaushal, Principal at JLL Spark Global Ventures, framed this shift succinctly, noting that venture capital still plays an important role in validating early value creation, but “beyond a certain point, VC dollars aren’t the right dollars to scale capital-intensive businesses. That’s where you’re seeing debt come in.”

Zandieh echoed this view, adding that “as proptech increasingly intersects with housing finance, construction, and energy infrastructure, the capital stack is beginning to resemble the built environment itself. Asset backing and cash-flow durability matter more than narrative alone.”

Venture capital, by contrast, moved decisively earlier. Median round sizes hovered around $6 million, and the majority of transactions by volume occurred at the seed and Series A stages. Investors pushed upstream to secure ownership in capital-efficient companies before scale, recognizing that many startups may never require large growth-stage equity rounds.

This shift created a bifurcated valuation environment. Seed valuations remained elevated throughout the year, supported by competition for early ownership in technically differentiated and capital-efficient businesses. Growth-stage valuations, however, compressed materially. Jenny Song, Partner at Navitas Capital, captured this tension clearly, noting that while early rounds remain competitive, “Series A, B, and growth valuations are not,” particularly for companies unable to demonstrate exceptional growth or retention.

Nima Wedlake, Managing Director at V1 Ventures, illustrated the consequences with a real-world example, describing a company planning to exit the year with nearly $10 million in ARR, doubling year over year, yet still facing a difficult raise. The outcome, he noted, came in at a meaningfully lower multiple than would have been expected just a few years ago. In his words, “without a strong AI narrative or clear macro tailwinds, even good companies are being repriced.”

The absence of consistent, scaled exits in proptech continued to weigh heavily on late-stage equity deployment. As Kaushal observed, “at the growth stage, you really have to believe in the macro. The lack of strong exits makes writing $30 to $50 million checks far more difficult.” As a result, capital increasingly flowed toward structured instruments and asset-backed platforms in construction technology, housing finance, energy infrastructure, and insurance-adjacent businesses, where risk could be underwritten against tangible performance rather than future growth assumptions.

A structural shift in company formation reinforced these patterns. Advances in AI-enabled development, vertical software architectures, and cloud-native infrastructure significantly reduced the cost of building and scaling real estate technology. Many startups now reach meaningful revenue milestones with smaller teams and lower burn rates than in prior cycles. Kaushal remarked that founders are increasingly confident operating with fewer resources, adding that in many cases, “fundraising becomes less about necessity and more about visibility.”

This evolution altered both founder behavior and investor expectations. Startups raised what they needed rather than what the market once rewarded. For venture investors, this created a market in which early rounds were competitive and expensive, while later rounds were harder to justify because companies often did not require them. Zandieh summarized the shift plainly: “We’re seeing a generation of companies that are not built to raise endlessly. They’re built to operate.”

AI remained central to proptech investment in 2025, but its role changed meaningfully. CRETI’s data and investor feedback showed that AI was no longer a differentiator on its own. Instead, it became a baseline expectation. Capital flowed disproportionately to companies that combined AI with deep vertical specificity, operational integration, and measurable impact on underwriting accuracy, operating margins, asset management workflows, and capital allocation decisions.

Song noted that even strong revenue growth was insufficient without operational proof, emphasizing that “if companies aren’t six-xing, they’re not getting premium multiples,” particularly in crowded AI-enabled segments. Investors are increasingly focused on retention and real performance rather than novelty.

Zandieh framed the shift more broadly: “AI has moved from being the story to being the infrastructure. The question investors and operators are asking now is not whether AI is present, but whether it meaningfully improves how real estate is owned, operated, and financed.”

Geographically, capital flows diverged rather than converged. Europe continued to face challenges in venture fundraising despite solid portfolio performance. The Middle East emerged as a long-term growth market for development-driven proptech and infrastructure-adjacent platforms, with capital increasingly tied to expectations of local presence and ecosystem participation. North America rotated away from broad sustainability narratives and toward platforms with direct impact on cash flow and portfolio performance.

Taken together, CRETI’s 2025 data points to a venture market that has not contracted, but matured. Capital returned in force and surpassed pre-pandemic levels, yet it did so within a more disciplined, selective, and structurally grounded framework. Proptech venture capital is no longer driven by momentum or narrative. It is shaped by fit, durability, and alignment with the operating realities of real estate.

Looking ahead to 2026, the companies that are likely to succeed will be those built for capital efficiency and execution rather than scale for its own sake. The investors who perform best will be those who understand when equity is appropriate, when debt is superior, and how to underwrite technology businesses that increasingly resemble infrastructure rather than software experiments.

As Zandieh concluded, “The excesses of the last cycle are unlikely to return. What’s emerging in their place is a more analytical, more disciplined, and ultimately more durable proptech ecosystem. For investors willing to adapt, the opportunity remains substantial—but it will reward judgment far more than speed.”