Proptech Secures $531 Million in November: Trends Point to Construction Tech, Emerging Markets, and Sustainability

Proptech startups raised $531 million across 41 deals in November 2024, signaling cautious optimism from venture capitalists amid a maturing sector. The funding activity highlighted three dominant trends: an ongoing focus on construction technology, the rise of region-specific solutions in emerging markets, and the prioritization of sustainability in real estate innovation.

November Funding Overview

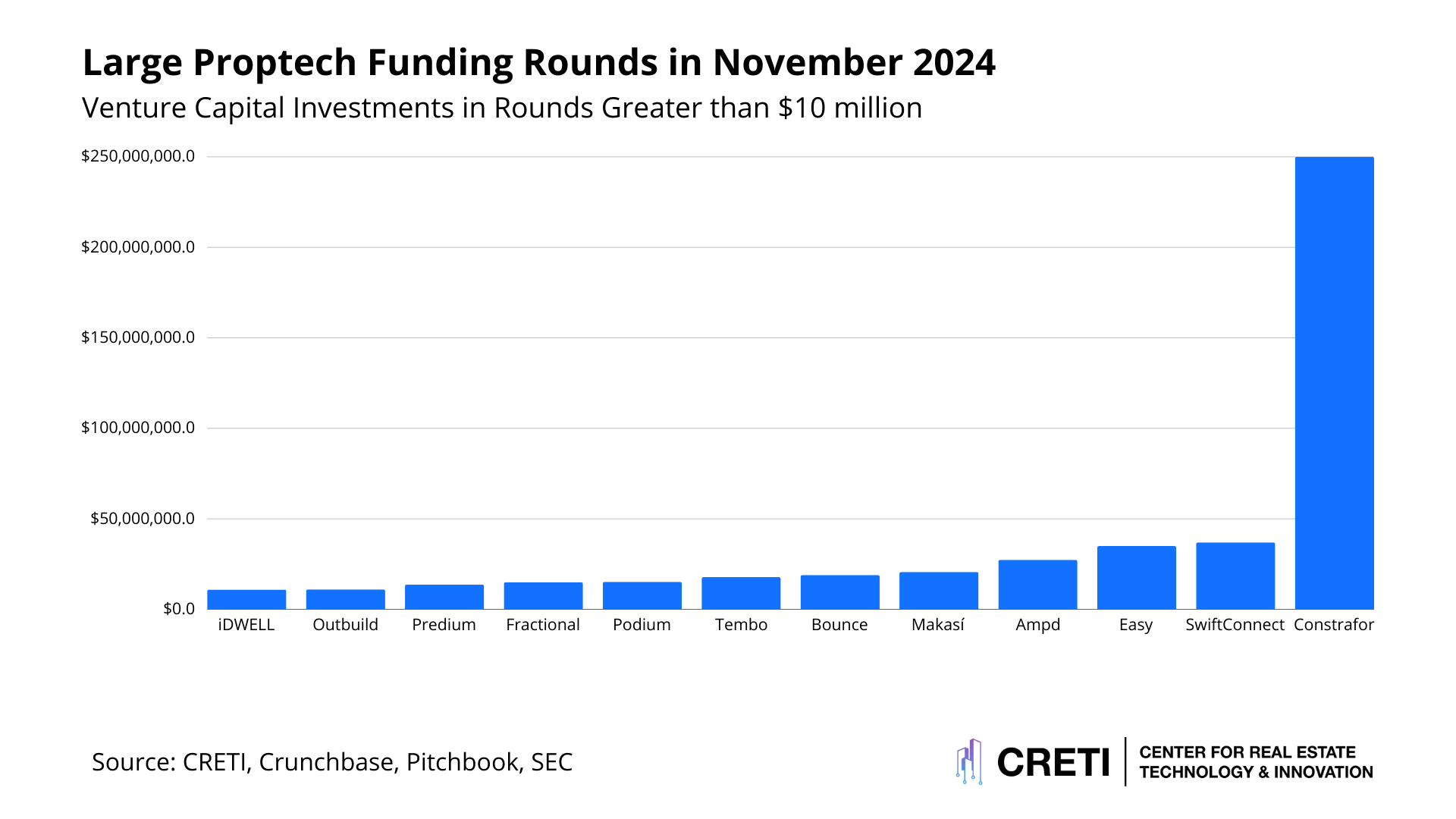

November saw a significant $531 million invested across 41 proptech startups globally, with a median funding amount of $5.4 million per company. This robust activity underscores the continued investor appetite for proptech solutions that address inefficiencies, digitize traditional processes, and align with environmental mandates.

The largest deals of the month included Constrafor’s $264 million venture-debt round, emphasizing liquidity solutions for contractors, and SwiftConnect’s $37 million Series B funding, which targets workplace access control. These two rounds alone accounted for more than half of the total funding, showcasing the dominance of growth-stage investments in construction and workplace technology.

Trend 1: Construction Tech Maintains Leadership

Construction technology remained the standout category in November, attracting the majority of funding. The industry’s persistent challenges—delays, labor shortages, and inefficient procurement—are driving innovation and investor interest.

Constrafor, a U.S.-based construction financing platform, led the month with a $250 million debt and $14 million venture round. Its solution enables contractors to access liquidity and streamline procurement, addressing critical pain points in the construction ecosystem.

Outbuild, another construction-focused startup, raised $11 million in Series A funding to enhance its AI-driven scheduling and workforce management tools.

This focus reflects the construction sector’s increasing reliance on technology to mitigate risks, improve efficiency, and navigate supply chain disruptions. As global construction demand rises, particularly in urban areas, the need for scalable digital solutions will continue to grow.

Trend 2: Emerging Markets Gain Investor Attention

Emerging markets are becoming hotbeds of proptech innovation, attracting $92 million across multiple deals in November.

Easy Home Finance, based in India, raised $35 million in a Series B round to expand its mortgage solutions across underserved cities. Its AI-driven underwriting platform offers scalable financial products tailored to local markets.

Makasí, a modular housing startup in Brazil, secured $20.6 million in private equity funding, highlighting the potential of pre-fabricated housing to address Latin America’s housing deficits.

Morada Uno, a Mexican startup focused on digitizing real estate transactions, raised $5.6 million in Series A funding to empower brokers and developers with seamless tools.

These investments signal a growing appetite for proptech solutions tailored to the unique challenges of emerging economies, including housing shortages, lack of financial inclusion, and rapid urbanization.

Trend 3: Sustainability Shapes the Funding Narrative

Sustainability remains a key driver of proptech investment as governments, consumers, and investors demand eco-conscious solutions. Companies providing modular housing, low-carbon materials, and efficient property management platforms stood out in November.

Ocean, a Seattle-based company specializing in ultra-low-carbon building materials, secured $1.8 million in seed funding. Its solutions cater to developers looking to meet stringent environmental standards.

Makasí’s $20.6 million round further highlighted the demand for modular housing solutions that reduce construction waste and accelerate timelines.

The increased funding for sustainable solutions reflects a broader trend: the alignment of real estate innovation with global ESG (Environmental, Social, and Governance) priorities.

What This Means for Proptech

November’s funding activity highlights several shifts in the proptech landscape, offering insights into how the sector is evolving:

Construction Technology Takes Center Stage

Startups like Constrafor and Outbuild underscore the continued reliance on construction tech to improve project efficiency and cash flow. These solutions are critical in addressing labor shortages, material procurement delays, and escalating project costs.Emerging Markets as Growth Frontiers

With $92 million raised in emerging markets, startups in regions like India, Brazil, and Mexico are proving their ability to scale and solve local challenges. Investors are keen to back companies addressing housing shortages and financial inclusion, particularly in high-growth economies.Sustainability Drives Innovation

The emphasis on modular, low-carbon, and eco-conscious solutions demonstrates that sustainability is now integral to the proptech sector. Startups that align with global ESG goals will remain highly attractive to both investors and customers.

Final Thoughts

What many expect to be the final significant month in the proptech venture, November 2024 marked a pivotal month for proptech, with $531 million raised across 41 deals. The funding activity highlighted three core themes: the dominance of construction tech, the growing influence of emerging markets, and the central role of sustainability in shaping innovation.