Weekly Proptech: Friday, September 9, 2022

This Week in Proptech

This Week in Proptech — $225 million was invested across 15 companies at a median funding amount of $5 million. Some of the largest funding rounds went to property management, commercial real estate, residential, multifamily, and other proptech companies.

Proptech in a Nut Shell: Venture capital investments increased by 28.6 percent in a week-over-week analysis of proptech capital allocation. Seed stage investments represented 25.0 percent of total investments, a 7.4 percent decrease in weekly Seed stage funding.

CRETI PROPTECH VENTURE INDEX

Why Does This Matter?

This week we took a look at the real estate tech and real estate insurance market to better understand the future of proptech enabled insurance industry.

In an analysis of real estate tech companies on the 2022 CRETI Insurance Index, $410 million has been invested in insurance-based proptech companies. The majority, 90 percent, of companies are spread across the residential real estate sector, including single-family residential and single-family rental sectors.

The residential real estate sector is the more mature of the proptech-insurance sector, with carriers either directly backing proptech companies as a top-of-funnel lead generation strategy or a tech-enabled brokerage.

What Does This Mean For PropTech?

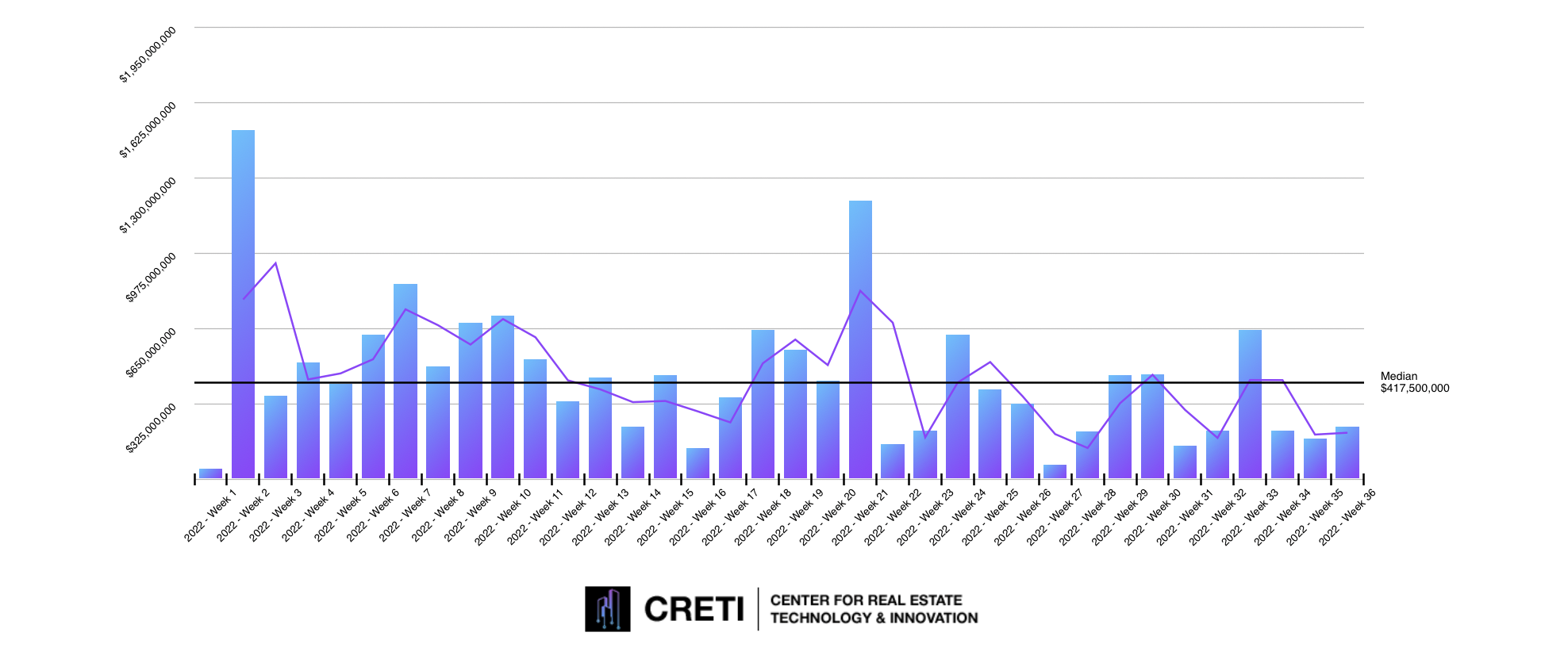

The rise of insurance-based proptech solutions has seen a surge in activity from technology investors. Since 2017, $2.680 billion has been invested in proptech-insurance companies at a median funding amount of $427.5 million per year.

2022 is on pace to exceed the annual median funding; however, the rising interest rate environment and the pandemic have had a very peculiar impact on the insurance industry. Two factors to monitor are (1) the increase in the price of premiums due to higher borrowing rates and (2) the phenomenal increase in claims and payouts in 2022 — coming off a low to no claims in 2022 and 2021 caused by the pandemic.

Despite the total allocation of capital, the market is far from mature, and opportunities remain across multiple sectors.

Moderne Ventures Announces its 2022 Midyear Passport Class

Moderne Ventures, a venture fund focused on technologies innovating around the real estate, finance, insurance, ESG, and home services industries, announced its 2022 Midyear Passport Cohort. The Passport Program is an intensive, six-month industry immersion program providing its participants education, exposure, insight, and relationships to drive customer growth. Moderne Ventures is currently accepting applications for its third class of the year launching in December.

Notable Rounds of Funding

September 8, 2022 — Dealpath, a San Francisco-based commercial real estate deal management platform, raised a $43 million Series C round led by from Morgan Stanley Expansion Capital with investments from Blackstone, Nasdaq Ventures, JLL, GreenSoil PropTech Ventures, and 8VC.

September 6, 2022 — VTS, an NYC-based commercial real estate CRM platform, raised a $125 million Series E round led by CBRE with investments from AmTrust Financial Services, Brookfield Growth, Insight Partners, and BentallGreenOak.

September 7, 2022 — StayVista, a Mumbai, India-based home rental management platform, raised a $5 million Venture round led by DSG Consumer Partners with investments from Capri Global Capital and CA Holdings.

EVENTS

Sessions We're Attending at Blueprint

How the Largest CRE Landlord in the US Evaluates New Tech

The Great Automation of Industrial Real Estate

How the Market Reset Will Revalue Proptech

The Convergence of Tokenization, Real Estate, & the Metaverse

Ground Truth: Real Talk on Tech Implementation in CRE

and more...

Driving Proptech Headlines

NEWS - MULTIFAMILY TECH

Top Trends in Proptech for Residential Property ManagersNEWS - PROPTECH

Today’s Data Is Tomorrow’s Bigger PictureNEWS - PROPTECH

Moderne Ventures Announces its 2022 Midyear Passport ClassFUNDING - VENTURE CAPITAL

Building Ventures raises $95M for Fund IIFUNDING - RESIDENTIAL TECH

JustHome raises $3.3M in pre-seed fundingFUNDING - OFFICE TECH

VTS Raises $125M in Funding Round Led by CBRENEWS - CRE TECH

Proptech firm Juniper Square lays off 14% of staffFUNDING - CONSTRUCTION TECH

Project Hero Grabs $3.2 Mn To Help Contractors Hire WorkersNEWS - PROPTECH

Pakistan Proptech Startup Scene a Standout Among Emerging MarketsFUNDING - CRE TECH

Dealpath Raises $43M Series C Led by Morgan Stanley Expansion Capital