Weekly Proptech: Friday, July 29, 2022

This Week in Proptech

$452 million was invested across 22 companies at a median funding amount of $3.8 million. Some of the largest funding rounds went to construction, commercial, residential, insurance, and climate proptech companies.

The Market in a Nut Shell: The proptech industry had its best week in four weeks as Seed stage investments propped up the market. Seed funding represented the lion's share of deal volume at 53%.

Why Does This Matter?

This week was all about the federal reserve, inflation, and interest rates 🏦. At a macro level, venture capital investors and startups alike have entered a new reality of fiscal conservatism. However, this isn't your parent's interest rate hike.

Historically, interest rates were used as a tool to curb inflation. The mechanism is simple to understand, higher borrowing costs will lead to lower purchases. However, this isn't Paul Volcker's 1980's US economy, where the US was on the verge of bankruptcy where rapid growth of federal debt threatened the nation’s economic health.

Jerome Powell, the current Chair of the Federal Reserve of the United States, isn't battling a recession (not yet, at least). “I do not think the U.S. is currently in a recession, and the reason is there are too many areas of the economy that are performing too well,” Powell said.

What Does This Mean For Proptech?

Lions 🦁, Tigers 🐯, and Bears 🐻, Oh My! The recession, inflation, and stagflation have scared off generalist investors and have cleared a path for strategic proptech investors, namely corporate real estate organizations and professional proptech investors.

Follow the rainbow 🌈. In a CRETI Proptech Venture Capital Confidence Survey of 250 technology investors, a resounding 87.2% will exceed their 2021 investment levels. This is a good thing for proptech.

But where is the capital going? Later rounds of funding, namely Series B and greater, are under the watchful eye of financial discipline 🔎 💵. The era of general fast growth at any cost may be over, especially for mid to late-stage companies (at least for now). Similatiously, early rounds, namely Seed rounds, are getting a boost from strategic and late-stage investors.

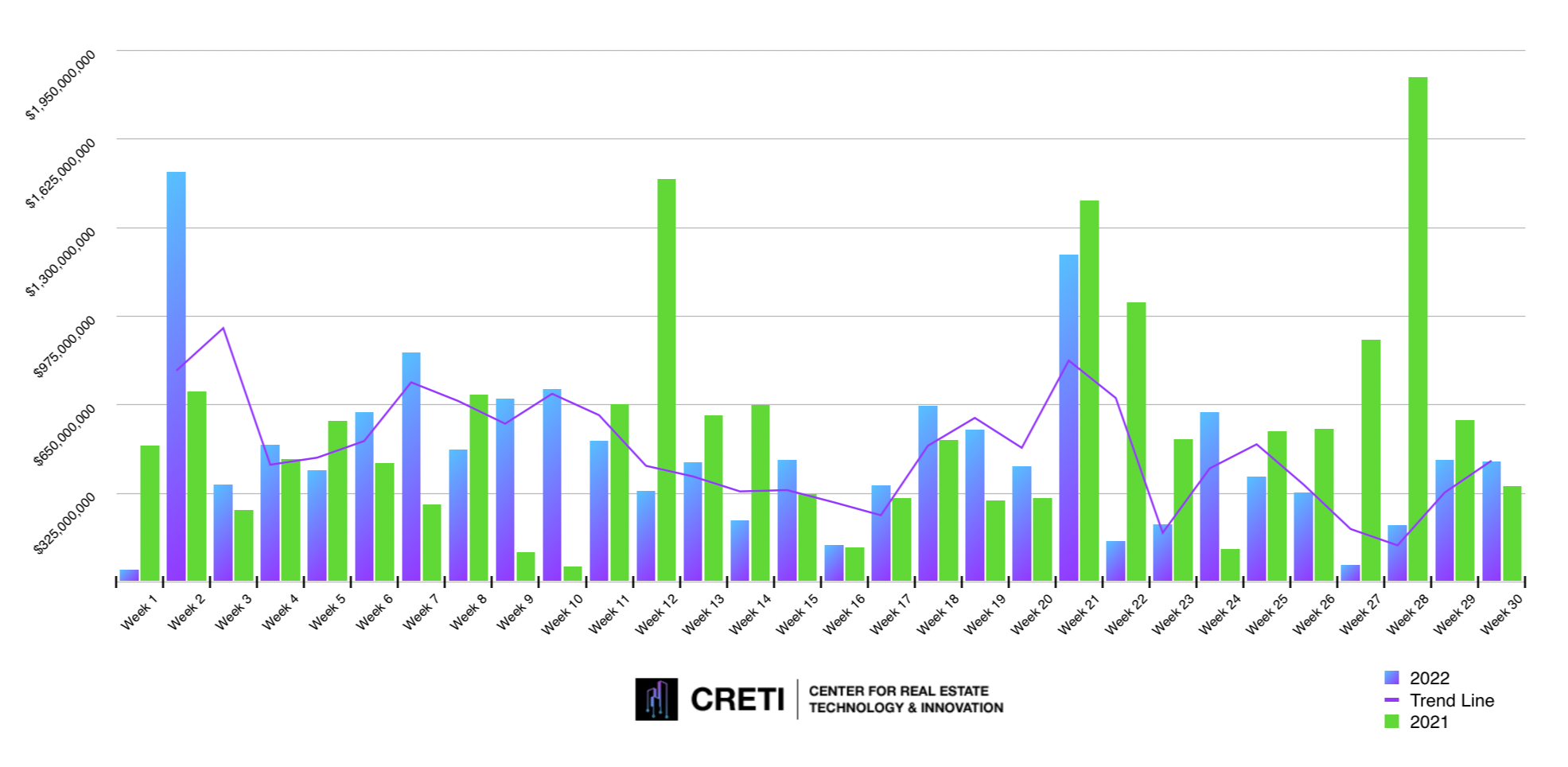

CRETI Venture Capital Index

CRETI Proptech Index

The CRETI Proptech Index is a private market real estate technology index tracking the financial performance of the proptech industry. It is the most followed proptech venture capital indices, globally. Contact us to learn more.

TOGETHER WITH EQUIEM

Equiem One: The First All-in-One TenX, Ops & Data Platform

Equiem One is a simpler way to manage and engage with your commercial property, built upon three pillars of Experience, Efficiency, and Intelligence. We've brought our tenant experience, building operations, and data analytics solutions onto a single platform to make your asset more manageable and more human.

Notable Rounds of Funding

July 25, 2022 — Nada, a Dallas-based real estate investment platform, raised a $8 million Seed Round led by LiveOak Venture Partners with investments from Revolution Ventures, Capital Factory, 7BC Venture Capital, Sweater, Stonks, and LFG Ventures.

July 25, 2022 — Kitchen United, a Pasadena-based turnkey cloud kitchen solution, raised a $100 million Series B from GV, Simon Property Group, Divco West, GoldenArc Capital, General Global Capital, RXR Realty, Rich Products Ventures, Kroger, Fidelity, Phillips Edison & Company, Restaurant Brands International, Payton Manning, and 7 other investors.

July 26, 2022 — Butlr, a San Francisco-based IoT intelligence platform, raised a $20 million Series A from Carrier, Tiger Global Management, Primetime Partners, E14, Unionlabs, Hyperplane and Tectonic Ventures.

Driving Proptech Headlines

FUNDING - CONSTRUCTION TECH

Cemex Ventures invests in 3D-printing tech for buildingFUNDING - CRE TECH

Butlr lands new cash to put people-detecting sensors in the officeFUNDING - CONSTRUCTION TECH

DigiBuild secures $4M seed round for blockchain-based construction management platformFUNDING - REAL ESTATE TECH

Home inspection startup PunchListUSA raises $39 million in Series AFUNDING - RETAIL TECH

Kroger And Restaurant Brands Invest In Kitchen UnitedNEWS - VENTURE CAPITAL

JLL Spark’s Raj Singh Still Can’t Believe Proptech’s PotentialFUNDING - CRE TECH

XY Sense Raises US$10M in Total FundingFUNDING - CRE TECH

Gaw Capital leads SG property portal 99.co's $52m roundNEWS - PROPTECH

PropTech Startup Makes Buying And Selling Your Home Easier And CheaperNEWS - PROPTECH

Austin mayor takes on advisory role with proptech unicorn Pacaso