This Week in Proptech - November 5, 2021

This week in a COP26 inspired weekly proptech, we analyzed venture capital investments in private renewable and sustainability companies solving for the decarbonization of the built world and the planet.

COP 26 is the United Nations Climate Change Conference. Organized by Climate Action, in partnership with the United Nations Environment Programme (UNEP) alongside the UNFCCC Conference of the Parties (COP), the forum generates robust debate and shares ideas, technology, and solutions that can be turned into positive actions.

According to our friends at Fifth Wall, in the United States, the real estate industry accounts for 13% of GDP but 40% of CO2 emissions. Factor in supply chain and logistics, which includes industrial real estate, CO2 emissions surpass 50%.

On a global level, according to research by the World Economic Forum, led by Coen van Oostrom (Co-Chair, World Economic Forum Real Estate Industry) and Christian Ulbrich (CEO, JLL) the framework for the future, the future vision of cities and buildings is based on four pillars: liveability, sustainability, resilience, and affordability.

Needless to say, a sustainable strategy for real estate organizations is table stakes. The opportunity for innovation and technology advancements led by the private technology sector is ripe.

Decarbonization Venture Index by CRETI

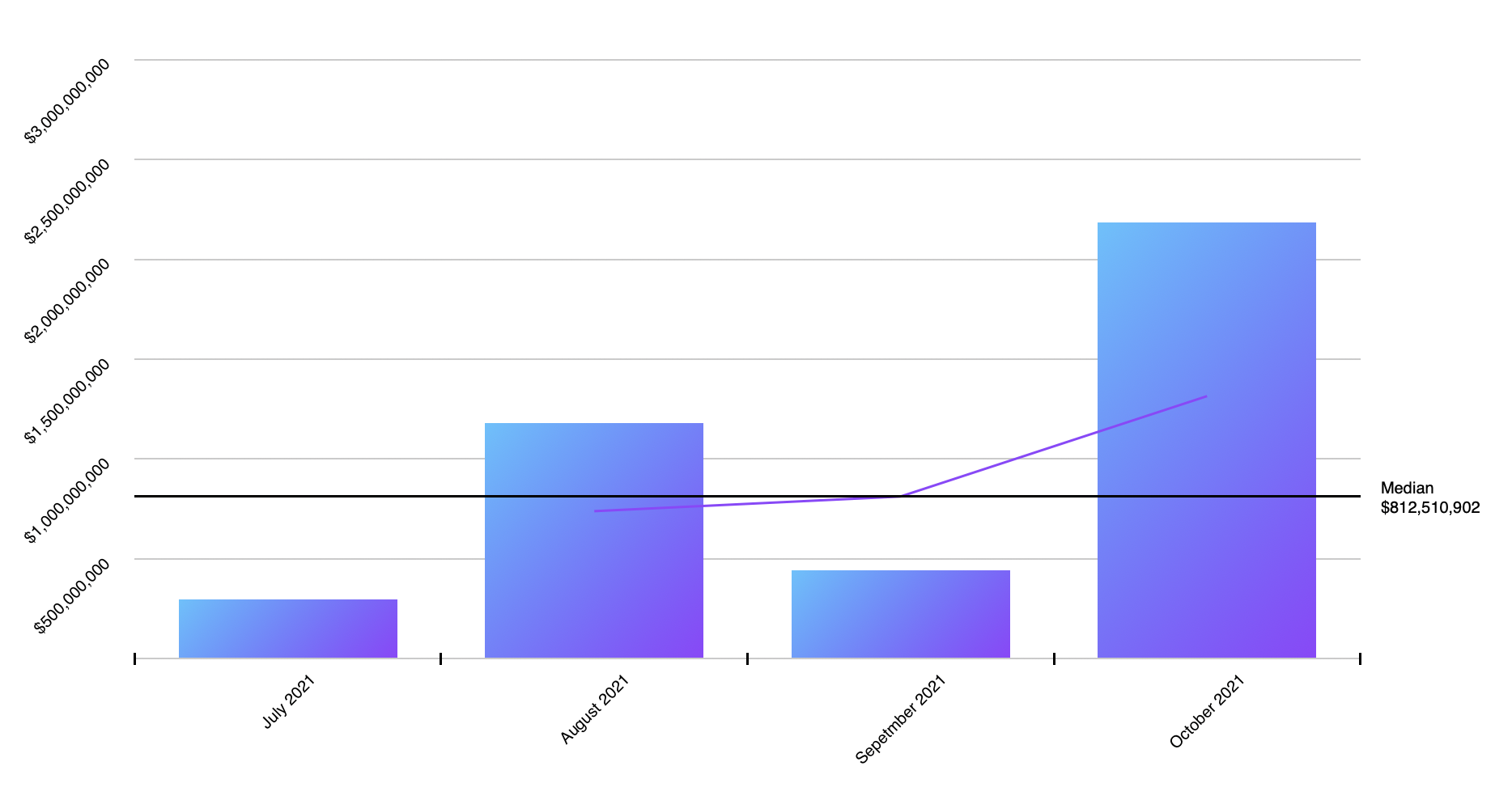

In Q3 2021, $1.922 Billion was invested across 32 private alternative energy companies, including renewable and sustainability companies solving for decarbonization. Month-to-Month investments, by dollar volume, increased by 118% reaching a peak of $1.2 Billion in August 2021, during the quarter.

Notable Rounds Q3 2021

Lancium Technologies | USA | $110 Million | www.lancium.com

Lancium is a technology company using distributed parallel computing to enable the growth of renewable energy.Sunfire | Germany | $126 Million | www.sunfire.de

Sunfire is an electrolysis company that designs and manufactures systems for the production of renewable industrial gas and fuel.NEoT | France | $92 Million | www.neotcapital.com

NEoT offers financing solutions in the fields of zero-emission mobility and clean and off-grid energy.Autogrid | USA | $85 Million | www.auto-grid.com

AutoGrid Systems organizes energy data and employs big data analytics to generate real-time predictions that create actionable data.Carbon Capture | USA | $35 Million | www.carboncapture.com

Carbon Capture is a climate tech company that makes machines that remove CO2 directly from the atmosphere.