This Week in Proptech - November 19, 2021

This week in a National Multifamily Housing Council OPTECH-inspired weekly proptech, we analyzed venture capital investments in private multifamily real estate technology companies and their impact on the real estate industry.

The National Multifamily Housing Council, also known as NMHC, is an association for leaders in the apartment industry. With the industry’s most prominent and creative leaders at the helm, NMHC provides a forum for insight, advocacy, and action that enables both members and the communities they build to thrive.

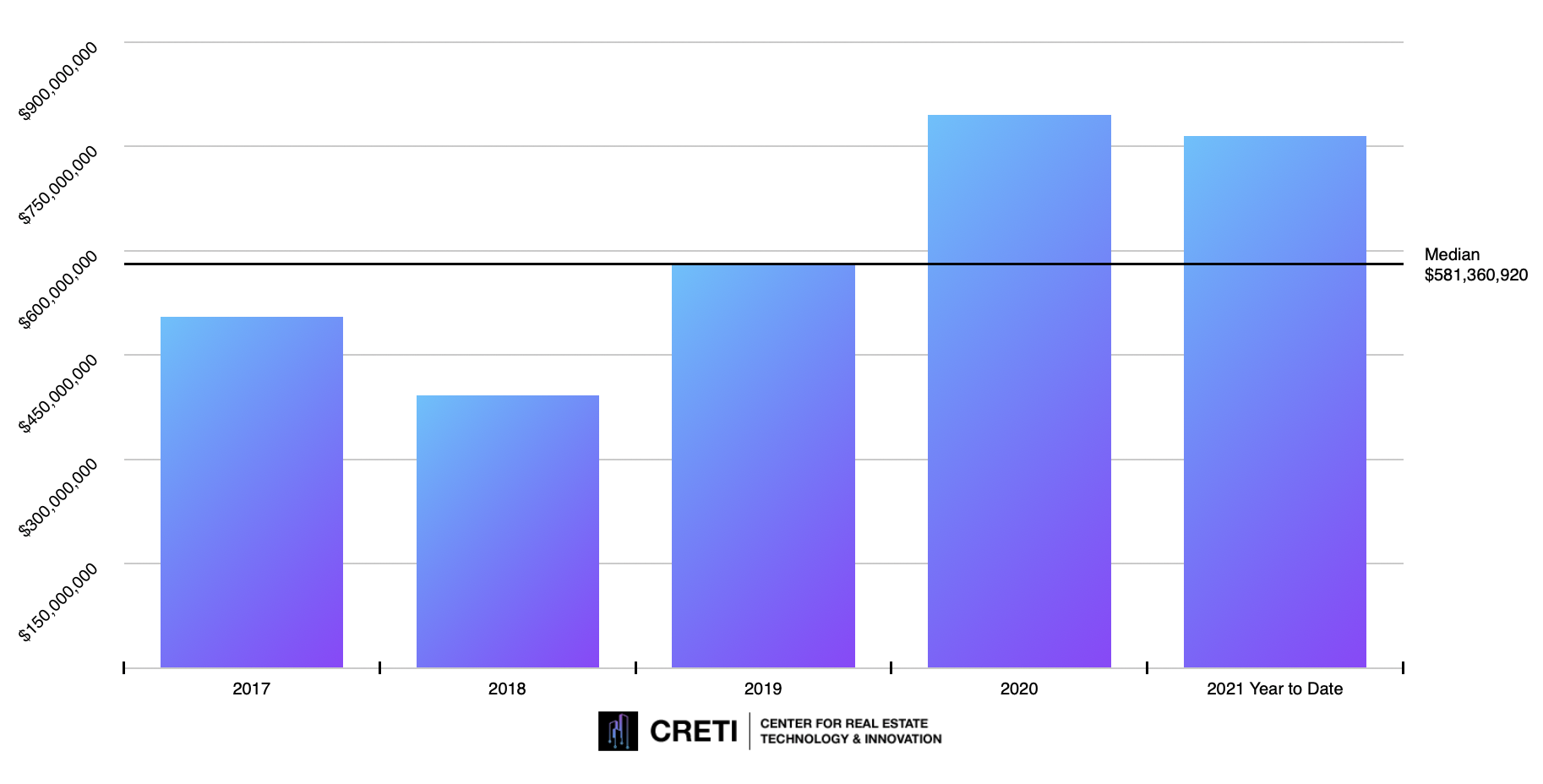

Since 2017, $3.04 billion has been invested in multifamily real estate technology across 193 companies at a median funding amount of $5.9 million.

Year-over-year, the compounded rate of growth, by dollar volume, has increased by 15% with $768 million invested in multifamily real estate tech companies year to date.

The increased flow of capital has also been met with an increased flow of new companies. Since 2017, an average of 29 companies per year have raised capital at an average growth rate of 2% per year.

Multifamily Venture Capital Index by CRETI

Notable Multifamily Tech Rounds 2021

Blueground | USA | $180 Million | www.theblueground.com

Blueground is a pre-furnished apartment rental startup focused on short-term and long-term rentals.Dwelo | Acquired | USA | $100 Million | www.dwelo.com

Dwelo is a Smart Device Management platform built to increase multifamily owners’ Net Operating Income.Veev | USA | $100 Million | www.veev.com

Veev is a hybrid real estate solutions company that reinvents the way homes are built and experienced.Landing | USA | $100 Million | www.hellolanding.com

Landing develops a membership-based network of fully-finished urban apartment homes.Lument | USA | $45 Million | www.lument.com

Lument offers custom capital solutions for investors in the multifamily, affordable housing, healthcare and commercial real estate sector.